Tennessee offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Clean Energy Financing and Funding

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Tennessee Government

600 Dr. M.L.K. Jr Blvd, Nashville, TN 37243

(615) 360-4326

[email protected]

Monday – Friday, 9:00 a.m. – 4:00 p.m.

Tennessee Valley Authority

400 West Summit Hill Drive, Knoxville, TN 37902

(865) 632-2101

[email protected]

Tennessee Department of Environment and Conservation

312 Rosa L. Parks Avenue, 2nd Floor, Nashville, TN 37243

(615) 532-0109

[email protected]

Monday – Friday, 9:00 a.m. – 4:00 p.m.

Nashville Weather Bureau

500 Weather Station Road, Old Hickory, TN 37138

(615) 754-8500

[email protected]

Open Daily, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

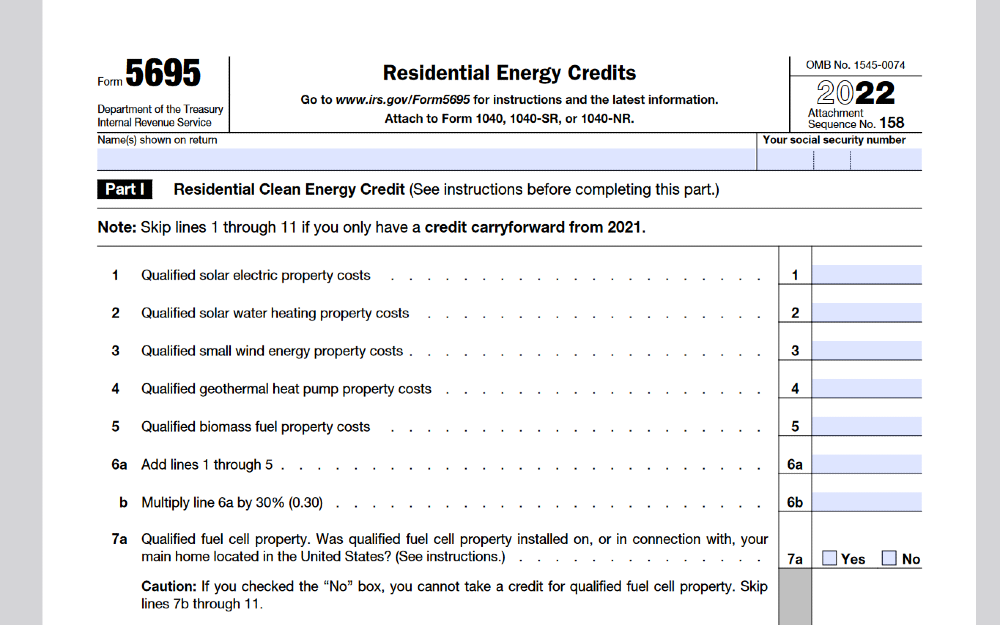

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Tennessee Clean Energy Power

Energy Efficiency and Renewable Energy Loan Program

Home Uplift Program

Fast Charge TN Network

Contact

Solar for All

Qualified Energy Conservation Bonds (QECBs)

Energy Efficiency Revolving Loan Fund Capitalization Grant Program

Power Outage Map

Tennessee Office of Sustainable Practices

312 Rosa L. Parks Ave. – Tennessee Tower – 2nd Floor

Nashville, TN 37243

(615) 920-9429

Programs

Resources

Funding

Go Green With Us

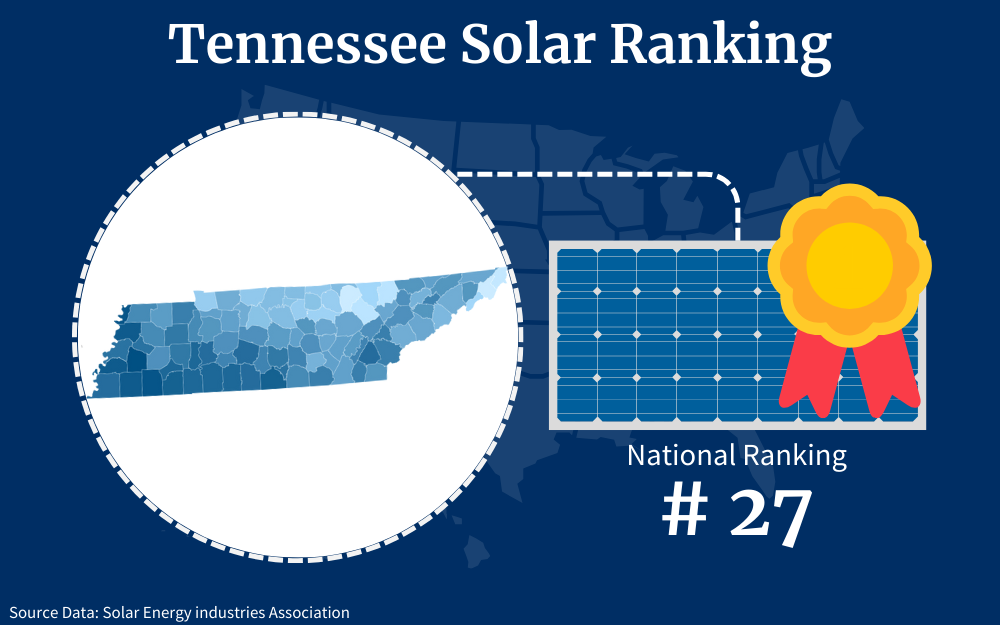

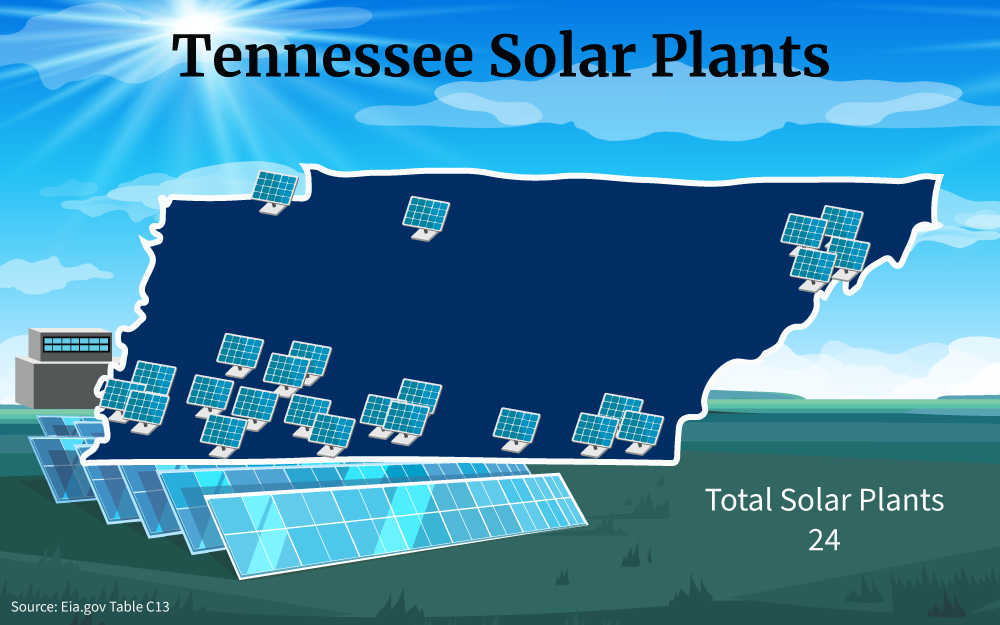

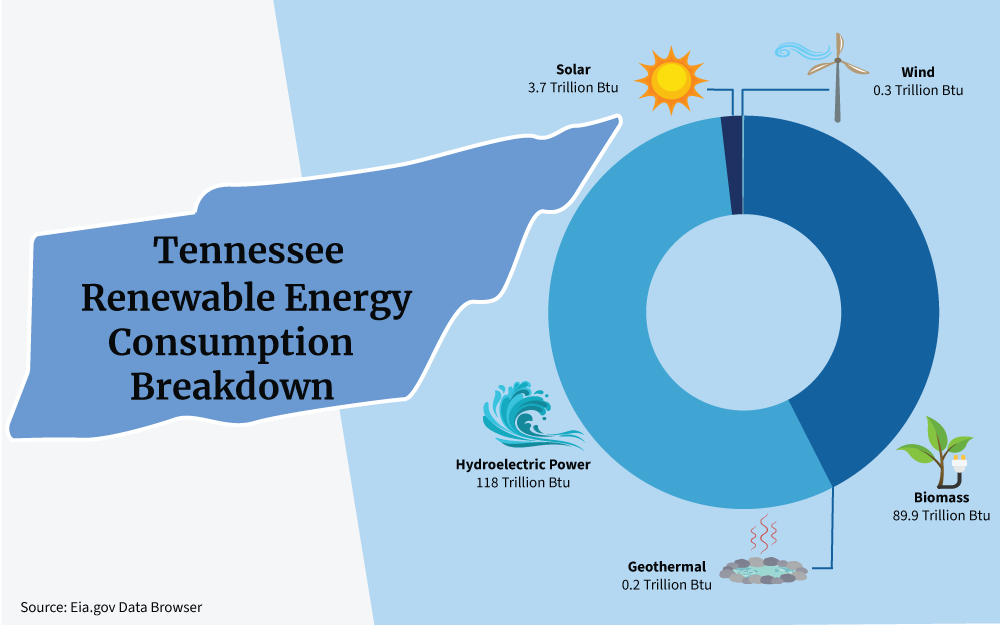

While Tennessee is one of the top five states in hydropower production, it isn’t leading the charge with solar energy production and has very limited Tennessee solar incentives available for residents.

As of 2023, it ranks 27th, and unlike many states, it doesn’t require a certain amount of its energy needs to come from renewable sources.

Tennessee Solar Credits Overview

Like elsewhere in the country, the cost of solar energy systems has decreased steadily in the last decade.

Between the lower costs of solar panels and several federally funded Tennessee solar incentives and renewable energy rebates, residents of the Volunteer State can make a more affordable transition to solar energy.

Solar tax credits are probably the most valuable and immediate way to lower your solar energy system costs.

While deductions lower income subject to taxes, tax credits directly reduce your final tax balance. For example, if you owe $8,000 and receive $4,000 in tax credits, you would only owe the government $4,000.

Federal and State Offerings

Tennessee residents can avail themselves of the federal tax credit available to everyone in the country. As for tax-related Tennessee solar credits, there isn’t much going on besides a partial property tax exemption,1 which isn’t a credit.

Claiming the federal credit is a pretty simple process.

- Fill out the designated form to calculate expenses, and add this number to the corresponding line in the standard federal form for individual income tax, known as the 1040.

- Collect all the necessary documentation to support your claim.

- Carefully read the instructions for the tax form you’re using. The instructions will provide guidance on where to enter the information related to the tax credit.

- After you submit your return, the IRS will process it. This may take some time, and you can track the status of your refund if you’re eligible for one.

EERE Programs Explained: Residential Solar Tax Credits

Here are two of the residential solar tax credits that you can get when you choose to install a solar panel system on your property.

Green Energy Property Tax Assessment

Any upgrade to your home that increases its value can lead to an increase in property taxes. While you won’t receive any direct savings in the form of tax credits with the Green Energy Property Assessment, this is a valuable incentive that saves you money by reducing the amount of property tax owed for installing a solar power system.

Tennessee only taxes 12.5% of the cost of your installation. For example, if your home is worth $250,000 and you install a $16,000 system, you won’t be taxed on $266,000 worth of property. You would only be taxed annually on $2,000. Given the state’s property tax rate of less than .06%, this would equate to an extra $12 a year.

Residential Clean Energy Credit

The Residential Clean Energy Credit is a federal program that allows you to deduct 30% of your solar system installation costs. This tax credit was implemented in 2006 and extended and expanded under the Inflation Reduction Act of 2022. The 30% deduction is valid through 2032 and will be reduced over the next two years, expiring in 2035 unless extended again.

There are no limits to how much money you can make to utilize the credit nor the amount of credit you can deduct. It is non-refundable, meaning if the credit exceeds your tax liability, the IRS won’t be cutting you a check for the excess amount. For example, if you owe $8,000 in taxes and have a $10,000 credit, you won’t receive a $2,000 refund. Fortunately, you can apply any excess credit to future tax bills for the next five years. You simply need to include Form 5695when you file your taxes.2

Some things to keep in mind about this credit:

- This credit only applies to first-time solar system installations.

- You must have purchased the equipment in cash or with a solar loan. You cannot claim the credit on leased equipment.

- Qualifying expenses include the PV panels and related equipment and soft costs such as installation, inspection, and permitting.3

- You must install the system on a residence in which you live, including vacation homes.

- Any costs for preparing your roof for the installation do not count toward a qualifying expense.

- Some incentives will reduce the qualifying expenses total, such as subsidies from a utility company.

This information is not a complete analysis of the credit, so if you are unsure about any aspect, consult a tax professional.

Can I Sell Power Back to the Grid?

When a solar power system generates excess energy, you may have an option to store this surplus energy on the local power grid. The utility company then uses this power for other residents; you can also draw on this power when your solar system cannot meet your needs, such as in the evenings or in poor weather conditions.

The credits you bank for the excess power your system delivers back to the grid get applied against any power you draw from it. Thus you are only charged for your ‘net use,’ which lowers your electric bills.

This process is known as net metering and is often a statewide program mandated by the legislature. Unfortunately, Tennessee law has not created such a program.

But the good news is you can avail yourself of the Tennessee Valley Authority’s Dispersed Power Program, which operates similarly to net metering.4 The utility will pay you for excess power produced at a reduced retail rate. This means you aren’t being credited the same amount of money the utility company would be charging a non-solar customer for using that same amount of electricity.

The application process will involve an inspection. You will need to pay a general application fee for the metering equipment to track how much energy you are sending to the grid and how much you are using. You can begin the enrollment process online.5 You also have the option to email or call a customer service representative, and you can find that information at the above link to the TVA site enrollment page.

Solar Power Purchase Agreements

Solar power purchase agreements (PPA) may be a good option if you don’t have the funds for a solar system, are not sure you want to make such a significant investment, or don’t want the responsibility of maintaining the equipment.

With a PPA, you contract with a solar provider to install a system on your property and pay wholesale rates for the energy you consume. The installer is responsible for installing and maintaining the equipment. Contracts are typically 25 years and are typically customized to your individual needs.

Some considerations for a PPA include:

- Have a thorough understanding of the contract terms. Circumstances can change over time, and with such a long-term commitment, you want to have a good sense of costs for early termination if it proves to be necessary.

- Will you receive a fixed rate the whole time, or will the contract have an ‘elevator clause’ that raises the rates over time?

- Have a good sense of your electricity needs by studying past electric bills to see if going solar will be the less costly option.

What Is Needed To Qualify for Solar Credits?

The federal tax credit is very straightforward. So long as you file the correct form noted earlier, along with your standard tax form, you are good to go.

The partial property tax exemption is the only state-level benefit, and you don’t need to do anything to ‘activate’ it. Your county commissioner reappraises residential properties every year, and this assessment will determine your property tax bill.6

The government does not provide state-wide rebates, but solar companies may offer this or other incentives, which is a particularly important reason to shop around and get quotes from a number of providers in your area.

Cost of Solar Panels in Tennessee: How Much Does It Cost for Solar Power Systems?

Many factors determine the cost of a solar project, so it would be hard to know the exact investment upfront. But there are figures available to give you a rough sense of the investment, particularly the average cost of solar power.

As of 2023, solar power in Tennessee typically averages about 2.49 per watt, with the average home installing a 12 kW system (12,000 watts). In this example, you would pay a little under $30,000 upfront, with the federal tax credit reducing the cost to about $21,000.

There are several panels on the market with varying degrees of efficiency, which will influence the price. Efficiency is measured by what percentage of sun’s rays the panels can convert into usable energy.

You may require work on your roof to prep it for the panel installation; you may need more extensive wiring depending on the placement of the panels.

A solar energy system is a significant investment, but long-term savings make it worthwhile, even in states like Tennessee, where electricity rates are on the lower end of the scale.

Solar panel materials have the biggest contribution to the total cost of solar panels. Here are some of the factors that affect the cost of solar power systems in Tennessee.

Solar Panels: How They Work

The most obvious equipment is the solar panels, which absorb the energy from the sun and convert it into the power that runs through your home. Several solar panels on the market vary in technology, design, and efficiency.

Most are made from silicone because this substance exists abundantly in nature and converts power very efficiently. After 25 years, silicone panels can produce energy at 80% of their original capacity.

There are two main types of panels that you see on solar arrays– monocrystalline and polycrystalline. The former’s darker hue allows it to absorb more light, making it more efficient and more expensive.

Inverters

Converting the sun’s rays into a source that will power everything from your A/C to your iPad is pretty simple. The panels absorb the sun’s energy and convert it to direct current (DC) power. But because most homes run on alternate current power (AC), you need to convert the energy from the former form to the latter. This is where inverters come into the process, and there are three options available to you:

- String inverters, also called centralized inverters, treat your solar panels as a single entity in converting their power. String inverters are the least expensive option because they won’t convert energy as efficiently. If they treat the panels as one unit, one individual panel not performing as effectively–due to its location in a more shaded area for example–will impact how well the string inverter converts energy overall.

- Microinverters are the most efficient and most expensive option. Unlike string inverters, they connect individually to each panel, squeezing the most ‘energetic juice’ from each one. So when one panel isn’t performing well, it will have no bearing on converting the energy of the rest. This type of inverter allows you to monitor the performance of each panel individually. Whether or not you need a microinverter will depend on a number of factors. If your roof has optimal conditions, such as a south-facing orientation and ample space to position all the panels in the same direction, you may not require one.

- Power optimizers are basically a cross between string inverters and microinverters. Like the latter, they attach individually to each panel but don’t convert energy as efficiently. They are not true inverters, but rather ‘prepare’ the DC current for conversion and deliver it to a centralized inverter. Power optimizers may be a good option if your system may experience reduced functionality due to shading issues or if you can’t place all the panels in the same direction.

Racking

You can’t just place solar panels directly onto the roof, even though that is how it often looks when viewing them from afar. This is why you need solar racking equipment. The racks allow the panels to be installed at optimal angles for maximal performance and protect the roof from damage.

When thinking of solar panels, most people picture them on the roof, but they are sometimes installed on the ground for various reasons, such as a roof not having enough space for the number of panels a home requires. In this instance, the equipment is ‘mounting’ and not ‘racking’ but serves a similar purpose. Sometimes panels are placed permanently in one spot and orientation (fixed mounts) or set up so you can move them to follow the sun during the day (track mounts).

Monitoring Equipment

If you don’t track your system carefully, you won’t get the most out of it. Maximizing efficiency is the key to maximizing savings. Seeing your panels in action and the subsequent savings can be quite a satisfying experience! The equipment will calculate your hourly energy production. Monitoring equipment will alert you to any performance issues, and you can opt for on-site monitoring installed on the panels or off-site systems stored in the cloud and accessible online.

Solar Battery

Solar energy only gets produced when the sun is shining, meaning there are times when your panels aren’t producing energy to use in real-time. You can store excess energy with solar batteries and draw on it in the evenings or in cloudy and rainy weather conditions. Solar batteries are not required equipment, and whether it makes sense to invest in this still-expensive technology will depend on several factors, such as whether your state has programs that allow you to store excess energy on the grid. When storing excess solar energy on the grid, you receive credits for this energy that will be applied against your electricity consumption.

If you decide to invest in a solar battery, the good news is that as of 2023, it counts as a qualifying expense for the federal tax credit.

Solar Panel Calculator: Requirements and Cost Savings

While many factors go into determining the total cost of your solar project, the panels will be the primary expense.

The installer will ultimately determine how many you require to meet your energy goals, but you can run some rough calculations on your own manually or through a solar estimator app to get a sense of how many you may need, which may give you a ballpark sense of your investment.

There is a basic formula to calculate the number of panels. Solar panels come in different wattages, and the wattage is an important part of the calculation. You can plug in a few numbers to get a range. Most panels used for residential purposes are between 250 and 400 watts. The higher the wattage, the more kilowatt hours (kWh) the panels produce.

Basic Calculation

To determine how many panels you need, you will divide the number of kilowatts (kW) you need by how many watts the solar panel has.

kW needed/solar panel wattage = Number of panels needed

The ‘data’ you need to determine the above is as follows:

How To Determine the Number of Solar Panels

Step 1: Determine historic energy usage. Look at your electric bills over the year to see how many kWh you use monthly. This number will probably not be the same every month since you likely use more energy during certain periods, such as the dead of summer. It may help to calculate an average.

Step 2: Determine daily usage by dividing your monthly usage by 30.42 (this figure comes from dividing 365 by 12)

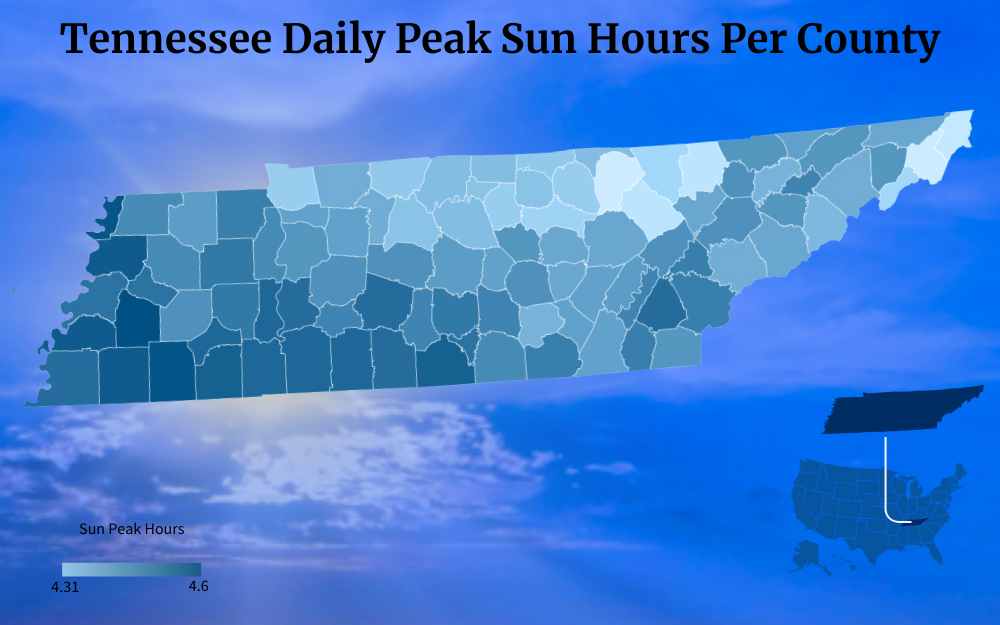

Step 3: Determine your daily energy needs. You need to know the peak sunlight hours of your location, and Tennessee typically gets 4.1 to 4.25 hours a day. Peak sun availability is important to determine your panel needs since peak sunlight is when they will produce almost all the energy they can. Dividing your daily energy consumption (figure in step 2) by peak sun hours will give you your daily energy needs.

Step 4: Determine your panel’s output. As mentioned above, you may plug in a few different numbers here since the wattage varies. To calculate output, divide the wattage by 1,000. For example, if you used the lower end of 250 watts, output would be .25

Step 5: Divide the daily energy needs (figure in Step 3) by the panel’s output (figure in Step 4) and the resulting figure is the number of panels you require.

How Much Money Will I Save With Solar?

On average, a Tennessee resident will recoup the costs of their solar power system in about 13 years, a year longer than the national average. Some residents may recoup their investment in as little as 10.

A decade or more may sound like a long pay-back period, but considering a system lasts at least 25 years, you will experience significant savings over the long term. While Tennessee may have lower electricity costs compared with elsewhere in the country, its residents’ use is about twice the national average.7

Given a typical solar power system lifespan of 25 years and the typical power usage in the state, you may save up to $55,000 or more, depending on inflation rates.

How much money you will save with solar energy depends on numerous factors, from your system design to roof conditions to how much you plan to use the sun’s rays to offset your energy costs.

Knowing that the lifespan of solar panels is quite long, the frequency of how often do solar panels need to be replaced is very minimal.

Where To Buy Solar Panels in Tennessee

As of 2023, Tennessee has over 60 companies focused on solar installation, so you have plenty of options. The approach to choosing a solar installer is really no different from that of any home improvement project. But given the significant investment, it is particularly important to heed these ‘best practices.’

Proper Credentials

Choose an installer certified by the North American Board of Certified Energy Practitioners.8 Be sure the company is appropriately licensed and bonded per the requirements of Tennessee.

Experience and Ease of Communication

Go with an installer with at least a few years of experience. Ask how many installations they have done. Good communication is important when dealing with such a big project. How well do they explain the different aspects of the project and installation process? How well do they explain why they use the panels and other equipment that they use? Do they seem transparent and happy to answer your questions?

Reputation

Check if the company has any complaints on the Better Business Bureau or inquire with the Tennessee Division of Consumer Affairs.9, 10

While Tennessee lacks many of the incentives other states offer to make the switch to solar more attractive financially, the federal tax credit alone makes the transition much more feasible.

Given high energy usage in the state, solar power has the potential to offer you significant savings over the long term through federal and Tennessee solar incentives, making the investment more than worth it.

Frequently Asked Questions About Tennessee Solar Incentives

Will Solar Increase Property Value in Tennessee?

For every $1 you save with solar energy on your yearly bill, your property value increases by $20.

Does Tennessee Have Solar Access Easement Laws?

Yes, it does. These laws protect your properties with solar systems from new developments interfering with your system’s access to sunlight.11 In the event construction had to be built that interfered with your system, there is a system in place to determine compensation.

Is Tennessee Working Towards Greater Solar Power Production?

Yes, it is. The state has already invested over 1.2 billion dollars, and over 93,000 homes run strictly on solar power. This growing usage accounts for panel prices having come down over 54% in the last decade.

References

1DSIRE. (2023, May 25). Green Energy Property Tax Assessment. DSIRE. Retrieved September 21, 2023, from <https://programs.dsireusa.org/system/program/detail/5216>

2Internal Revenue Service. (2023, February 17). About Form 5695, Residential Energy Credits. IRS. Retrieved September 21, 2023, from <https://www.irs.gov/forms-pubs/about-form-5695>

3Solar Energy Technologies Office. (2023). Soft Costs. Office of Energy Efficiency & Renewable Energy. Retrieved September 21, 2023, from <https://www.energy.gov/eere/solar/soft-costs>

4Tennessee Valley Authority. (2023). Dispersed Power Production Program. TVA | Tennessee Valley Authority. Retrieved September 21, 2023, from <https://www.tva.com/energy/valley-renewable-energy/dispersed-power-production-program>

5Tennessee Valley Authority. (2023). TVA Enrollment Page. TVA | Tennessee Valley Authority. Retrieved September 21, 2023, from <https://www.tvagreenconnect.com/enrollment/enteraddress>

6Tennessee Comptroller of the Treasury. (2023). Understanding Tennessee Property Assessments. Tennessee Comptroller of the Treasury | Propery Assessments. Retrieved September 21, 2023, from <https://comptroller.tn.gov/office-functions/pa/property-taxes/understanding-tennessee-property-assessments.html>

7U.S. Energy Information Administration. (2023, August 17). Tennessee Profile Data. EIA. Retrieved September 21, 2023, from <https://www.eia.gov/state/data.php?sid=TN>

8NABCEP. (2023). NABCEP Homepage. NABCEP. Retrieved September 21, 2023, from <https://www.nabcep.org/>

9International Association of Better Business Bureaus, Inc. (2023, September 5). BBB Homepage. BBB | Better Business Bureau. Retrieved September 21, 2023, from <https://www.bbb.org/>

10State of Tennessee. (2023). Consumer Affairs. TN.gov. Retrieved September 21, 2023, from <https://www.tn.gov/attorneygeneral/working-for-tennessee/consumer-affairs.html>

11DSIRE. (2020, May 29). Tennessee Solar Easement and Access Laws. DSIRE | NC Clean Energy Technology Center. Retrieved September 21, 2023, from <https://programs.dsireusa.org/system/program/detail/18/tennessee-solar-easement-and-access-laws>

12Music City Center – solar panels Photo by Rex Hammock / Attribution-ShareAlike 2.0 Generic (CC BY-SA 2.0). Resized and Changed Format. From Flickr <https://www.flickr.com/photos/rexblog/8459473000/sizes/l/>